People always ask if their workers’ compensation payments are taxable. Its a great question as you know that old joke that the only things  that are certain are death and taxes. Fortunately, we’ve got good news for you!

that are certain are death and taxes. Fortunately, we’ve got good news for you!

According to the IRS website, ” Amounts you receive as workers’ compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers’ compensation act or a statute in the nature of a workers’ compensation act. The exemption also applies to your survivors. The exemption, however, does not apply to retirement plan benefits you receive based on your age, length of service, or prior contributions to the plan, even if you retired because of an occupational sickness or injury.”

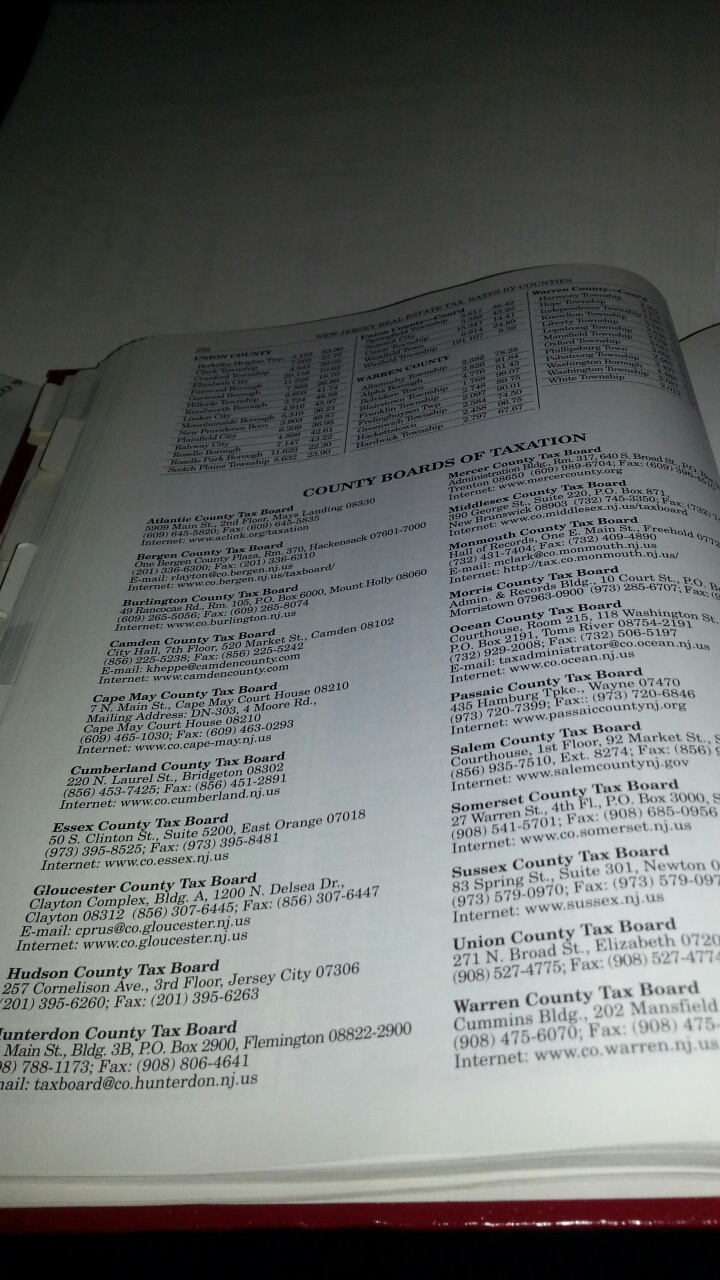

Furthermore, according to the New Jersey Department of Labor’s website, “Workers’ compensation benefits are not taxable as per the NJ Gross Income Tax law NJSA 54A:6-6.”

If you or anyone you know would like to speak to a New Jersey Workers’ Compensation attorney, please call Corey Morano at The Morano Law Firm for a free consultation at 201-598-5019 or email [email protected] today!